The Art of Physician Consolidation

Now more than ever, individual physician practices face complex challenges and an unpredictable industry environment. One way to protect themselves from these challenges and the obstacles associated with evolving market dynamics is to grow.

Download PDF

Listen to Webinar

Contributors

Roy Bejarano

Co-Founder & CEO

Emma McGregor

Associate

Elizabeth Scoda

MBA Intern

Gary Herschman

Health Care and Life Science Attorney, Epstein Becker & Green

Overview

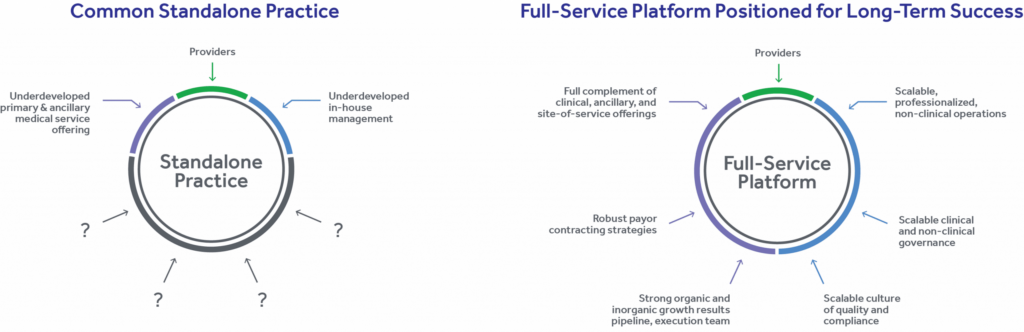

Growth can be beneficial regardless of whether a group wants to remain independent, or partner with a hospital, private equity investor or national healthcare company. Being part of a larger organization has many benefits that can enhance a group’s ability to survive and thrive in the uncertain future, most significantly by having a professional, corporatized infrastructure – such as advanced EMR, finance department, managed care contracting, population health expertise, billing/collection, HR and compliance functions, etc. – that can be shared by many, as well greater access to capital for strategic positioning, and weathering pandemics and economic downturns. Physician practices are thus faced with a very difficult decision – how do we grow?

This whitepaper focuses on why practice consolidations offer a broad range of benefits to stakeholders and can result in a more valuable or sellable platform in the future, or increase the likelihood of success in remaining independent. We at SCALE, along with the expertise of our vast network of operating partners, have developed a playbook for executing a successful physician growth strategy, and believe that practice consolidation is a significant opportunity for many existing physician practices looking to grow. Together, SCALE and consolidating practices are able to tackle the unique complexities that come with combining business processes; all while creating significant value in both the short and long-term.

In addition to health system growth, the market push to value-based care puts pressure on practices to grow in order to spread the risk and implement a successful value-based model.

Why is Growth Necessary?

Over the past five to ten years, we have seen transformation in the physician marketplace, including a significant decrease in private practice physicians and a correlated increase in those working in hospitals and large investor-minded companies. These large and growing health systems change the competitive dynamic for independent practices, who are now faced with the need to grow or develop a niche market in order to survive.

In addition to health system growth, the market push to value-based care puts pressure on practices to grow in order to spread the risk and implement a successful value-based model. Smaller practices do not have the operational ability or infrastructure to implement the models. Larger practices need to grow to reach the scale required for effective value-based care. Similarly, the formation of Accountable Care Organizations (ACOs) has also driven physician practices to grow in order to offer the coordinated care required.

Lastly, medical practices are becoming more complex from both an organizational and an operational perspective. Practices need to invest significantly in technology, be ready and able to quickly adapt to new regulation, compete on pricing, and otherwise maintain and/or grow market share.

Pressure to deliver higher-quality care and results conveniently and at a lower cost will continue. On top of preference changes for the ways in which healthcare services are delivered, there is a shift in expectations from patients, policymakers and payors alike. The fluctuating demands of provider care are diverse in nature and require an array of time, expertise, and resources to navigate. All of these dynamics and challenges require growth to overcome or execute a successful and effective strategy.

How Should Practices Grow?

“The question that must be answered is how to consolidate in ways that support independent physicians and improve patients’ access to cost-effective, high-quality care.” (1)

Unlike many other industries, physician practices are unable to sacrifice any segment of operations to ensure consistent quality with growth. Patients expect quality in every aspect of care that is provided. Thus, maintaining or improving the quality of care is a key consideration for organizational growth.

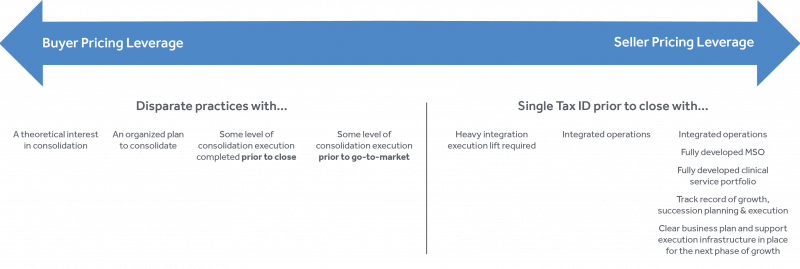

We generally see physician practices choosing to maximize their value through means of organic growth, practice consolidation, or some sort of timely mix between a private equity transaction and consolidation occurrence. However, we have found that the most effective pathway to create meaningful and significant value for many practices has been through the implementation of a practice consolidation strategy prior to initiating any private equity backing or other partnership with a large healthcare organization.

Standalone organic growth allows the physicians in charge to retain control and capture all of the upside benefits of growth. However, this method of growth tends to require a longer time to execute and has higher risk as all investment is supported by one entity. For example, practice mergers in advance of or simultaneous with a private equity deal can offer a catalyst for consolidation through the private equity partners. However, this process can reduce the list of potential longer-term viable buyers, create deal complexity, spread focus and priority across two projects – consolidation and an M&A deal – and thereby increase the potential for both forgone valuation upside and post-close execution risk. Practices that enter early private equity deals prior to scaling see a faster pathway to liquidity and delay merger integration complexity until after the deal closes. However, the up-front valuations are likely to be less as they reflect the practice’s limited scale and effort required to grow after the deal closes, and instead, the private equity firm captures most of the scaling upside.

Compared to the growth methods mentioned above, practice mergers prior to pursuing a private equity deal have the most benefits.

Although there is always some merger and integration risk, consolidation allows for a faster pathway to achieving scale relative to standalone growth, allows the practice owners to optimize their bottom line and strategic market positive prior to selling, and offers future add-on targets the competitive differentiation of being an independent alternative. By first putting a focus on the planning and implementation of the merger itself, consolidated practices are equipped to reap the most benefits if they do decide to later pursue a private equity arrangement (or other partnership) in their next step of development. Practice consolidation is not a substitute to a sale transaction, but rather, it is a step toward building a more valuable and sellable platform.

Through consolidation, the new organization formed is able to have significant opportunities the standalone practice may not. These opportunities include economies of scale, market attention, shared investment, diversification, access to capital and equity value.

Economies of scale is the ability to negotiate cheaper prices from suppliers by incr asing the number of purchases. A larger practice is able to enjoy this purchasing power. Market attention is in reference to the combined practice’s access to strategic partnerships, payor relationships, and referral relationships – all of which can help the newly combined group increase its value. Shared investment is all services that can now be shared across the large group rather than the smaller group – management expenses, marketing, technology and infrastructure, recruitment, and innovation. In terms of diversification, an expanded group enhances the provider and referral network stratification by bringing new providers into the fold and improves provider succession planning alternatives. Having greater access to capital allows a growing group to achieve all of the foregoing characteristics of a professional and corporatized infrastructure. Lastly, the combined group has an increased equity value – they have the momentum by being the larger group and a more developed practice of reasonable scale tends o receive a more favorable valuation.